December 19, 2023

Categories: Checking & Savings Accounts, Credit & Debit, Education & Security, Financial Planning

By GreenPath Financial Wellness

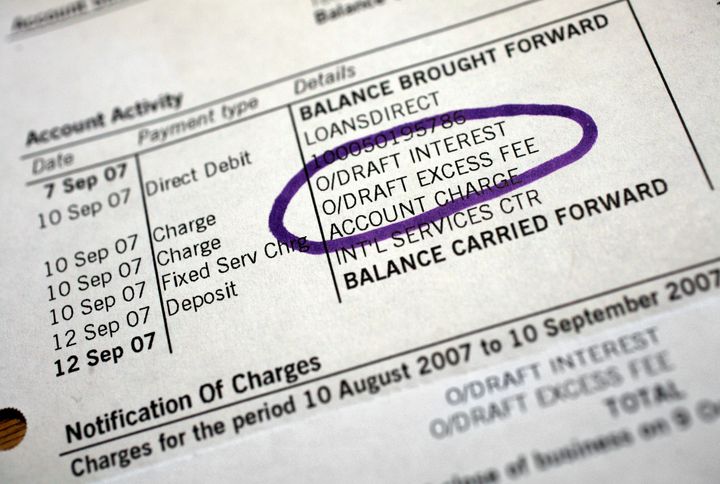

Savings, checking, and other accounts offered by your financial institution are important tools that impact your overall financial wellness. To improve confidence around healthy account practices, it’s important to understand the ins and outs of overdraft fees (or “Courtesy Fees” as they are known at The Summit).

Your institution may charge overdraft fees when there is not enough money in your account to cover your transactions. The cost for overdraft fees varies by financial institution. The most recent research shows that on average, overdraft fees are typically around $35 per transaction. Overdraft fees at The Summit are typically around $25 per transaction.

Consider these tips to manage or reduce the chance of overdraft fees:

- Know the terms: Financial institutions are required under Federal law to disclose any fees they charge in connection with a deposit account. Ask your credit union or bank for disclosures and fee schedules of overdraft fees for any transaction that overdraws an account. Be aware of any not-sufficient funds (NSF) fees, as well as continuous overdraft fees, or daily overdraft fees that the financial institution may charge.

- Track account balances: Get in the habit of regularly monitoring account balances which helps you avoid overdraft fees and NSF fees. Consider signing up for low balance alerts through your bank or credit union.

- Link to a savings account: Linking a checking account to a savings account can help reduce the chance of overdraft fees. If your checking account is overdrawn, money is automatically withdrawn from the linked savings account to cover the transaction if there are sufficient funds in the savings account. Be sure to understand whether you will incur a transfer fee. In general, transfer fees are lower than overdraft fees.

- Opt out of overdraft coverage: It’s possible to reduce stress by opting out of overdraft coverage for debit card purchases or ATM withdrawals. Without overdraft coverage, your card will be declined if you don’t have enough money in your account to cover a debit or ATM withdrawal. When the transaction is not able to be completed, you won’t incur an overdraft fee. At The Summit, opting out of overdraft coverage would only result in a decline for a one-time purchase or ATM withdrawal. Recurring transactions with a debit card would still be processed and incur an overdraft or Courtesy Pay fee.

- Make a plan: Many people find it useful to build a spending plan for their money. A simple spending plan makes it more likely that you will have enough money for what you need and the things important to you. Following the plan will also help you avoid a situation causing you financial stress such as overdraft fees.

Next Steps to Improve Your Financial Picture

At GreenPath, we like to say, “when you know more you can do more” and that applies to reducing your chance of incurring costly overdraft fees. Create your free LearningLab+ account to access interactive online courses to improve financial habits, manage credit and debt, use a checking account and more.

GreenPath offers a course for members of The Summit specific to managing a checking account: https://www.greenpath.com/checkright/summitfcu

This guide is shared by our partners at GreenPath Financial Wellness, a trusted national non-profit.